More than 30 percent of Swiss adults place bets on sports every year, and a dedicated segment of that group wagers far more than average, seeking bigger thrills and bigger returns.

If you are a serious bettor willing to lay down substantial stakes, standard bonuses can feel like small change. That is why offers such as the High Roller Bonus Schweiz attract attention. These exclusive promotions provide significant deposit perks, special cashback, and VIP treatments that align with the way high-stakes players think and play.

Being a high roller in sports betting means having the bankroll, the experience, and the mindset to place larger bets regularly. It is not just about spending more. It is about having strategic discipline and understanding value. High stakes come with greater risk, so the rewards need to be meaningful. Traditional bonuses that cater to casual players do little for people who want to push limits or maintain betting momentum over the long term. That is where high roller bonus structures come in, supporting more ambitious betting campaigns.

Understanding High Roller Benefits

At its core, a high roller bonus serves to increase the betting budget of players who are already contributing substantial funds. Larger deposit bonuses can mean more money to place on accumulator bets or key matchups.

Sportsbooks and casino brands structure these offers to keep valuable players engaged. While these types of bonuses are more common in the casino world, elements such as cashback, increased limits, and personalized perks are increasingly woven into sports betting promotions as operators compete for experienced bettors.

Certain platforms may offer boosted deposit matches on amounts that would otherwise exceed typical bonus caps. For example, instead of a 100% match up to a modest amount, a VIP-tier bonus might match deposits at a similar rate but with thresholds far higher. That immediately enhances a high roller’s bankroll. Some brands also introduce tiered cashback. In this setup, players receive a percentage of lost stakes back, either weekly or monthly. That safety net offers peace of mind when volatility is high.

How Larger Bonuses Support Betting Strategies

High rollers often favor strategic play. They study value lines, analyze probabilities, and look for inefficiencies. When a significant bonus is attached to their account, it can support more ambitious strategies. For instance, a larger bankroll from a generous bonus allows a player to run multiple parlay combinations or extend live betting sessions without draining funds as quickly. A healthy bonus can help cover variance and keep a player in the game during inevitable losing streaks.

Another advantage comes when bonuses unlock higher betting limits. Most standard players are capped at certain maximum bet sizes. VIP players often see those limits increased, allowing them to place wagers that align with their comfort levels. With higher limits, high rollers can optimize returns on strong convictions or hedge positions more effectively.

Choosing the Right Platform

Not all betting sites are created equal. When choosing where to place your action, look for platforms with a reputation for fairness and prompt payouts. VIP programs matter. A good one will present progressive benefits that unlock as you continue to wager. For example, players might start with free bets and then earn cashback percentages, exclusive event access, or personalized account support at higher tiers.

- Check the rollover requirements attached to a bonus, and compare them across platforms.

- Look at the maximum bet limits for both regular and VIP tiers.

- Review whether the bonus applies across sports markets or only to selected events.

- See if there are loyalty points or other ongoing rewards beyond the initial offer.

Experienced bettors often exchange tips about which operators have the most rewarding VIP structures. These discussions can be found in forums, social groups, and reviewing communities. Always verify that any platform you consider is licensed and regulated in Switzerland. This protects you and ensures disputes can be handled through proper channels.

Responsible Betting, Even For High Rollers

High stakes come with high responsibility. A generous bonus may pad your budget, but it does not eliminate risk. Professional bettors apply strict bankroll management and stop-loss limits. Even with perks like cashback, losses can accumulate if you do not stay disciplined.

Set personal guidelines about how much of your bankroll you are willing to risk each week or month. Consider using budget-tracking tools offered by many platforms. Some operators include built-in limits for deposits, wagers, and losses. These tools protect all bettors, but they are especially useful when stakes are large. Responsible gaming practices keep betting fun rather than stressful.

READ ALSO: Sports Betting Addiction and Its Impact on Society

Final Thoughts

For those who know how to balance risk and reward, exclusive bonus offers can give a meaningful boost to your betting journey. The right bonus enhances your bankroll, supports strategic play, and makes longer betting sessions more sustainable. When you consider opportunities like a high roller bonus and its perks, choose wisely. Evaluate terms, check limits, and always keep responsible gaming at the forefront. A well-chosen High Roller Bonus Schweiz can be a powerful tool for serious bettors looking to amplify both their fun and their potential returns.

Ask most bettors how they judge success, and you’ll hear the same answer: wins and losses. Did the bet cash or not? That mindset is understandable. Money is the point of betting. But it’s also the reason many bettors never improve, even when they’re placing bets through platforms like Nacional Bet apostas. Winning bettors think differently. They focus less on individual results and more on whether they consistently beat the line. Not because they ignore profit, but because they understand where profit actually comes from. Beating the line is about process, market truth, and sustainability. And those three things matter far more than any single outcome.

Ask most bettors how they judge success, and you’ll hear the same answer: wins and losses. Did the bet cash or not? That mindset is understandable. Money is the point of betting. But it’s also the reason many bettors never improve, even when they’re placing bets through platforms like Nacional Bet apostas. Winning bettors think differently. They focus less on individual results and more on whether they consistently beat the line. Not because they ignore profit, but because they understand where profit actually comes from. Beating the line is about process, market truth, and sustainability. And those three things matter far more than any single outcome. Line shopping is one of the few edges bettors can control. You are not predicting games better. You are simply choosing better prices. Over time, that difference matters. A half point here or a few cents there adds up faster than most people expect.

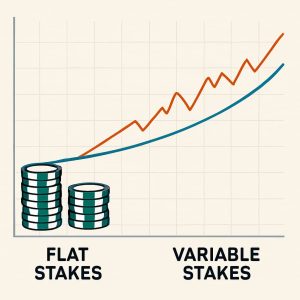

Line shopping is one of the few edges bettors can control. You are not predicting games better. You are simply choosing better prices. Over time, that difference matters. A half point here or a few cents there adds up faster than most people expect. Every bettor faces the same question sooner or later: how much should I stake on each bet? Some keep it simple and bet the same amount every time, while others adjust their stakes based on confidence, form, or perceived edge. Even platforms like Zeroum um bet ultimately reward bettors who understand this decision, because these two approaches, flat betting and variable stakes, sit at the center of long-term betting strategy debates.

Every bettor faces the same question sooner or later: how much should I stake on each bet? Some keep it simple and bet the same amount every time, while others adjust their stakes based on confidence, form, or perceived edge. Even platforms like Zeroum um bet ultimately reward bettors who understand this decision, because these two approaches, flat betting and variable stakes, sit at the center of long-term betting strategy debates.

The Italian market is flourishing on sports betting and casino games. The most popular sport to bet on has been football and specifically Serie A (the biggest professional football league in Italy), although there is growing popularity over esports like basketball and international events. In addition to this, slot machines, roulette, and live dealer games are still popular among many people.

The Italian market is flourishing on sports betting and casino games. The most popular sport to bet on has been football and specifically Serie A (the biggest professional football league in Italy), although there is growing popularity over esports like basketball and international events. In addition to this, slot machines, roulette, and live dealer games are still popular among many people.

The Olympics provide a one-of-a-kind betting opportunity because they only occur every four years. Having said that, bets should always be made in a responsible manner. Make a plan, adhere to it, and don’t ever try to recover losses.

The Olympics provide a one-of-a-kind betting opportunity because they only occur every four years. Having said that, bets should always be made in a responsible manner. Make a plan, adhere to it, and don’t ever try to recover losses. The Firepowers

The Firepowers

Sports betting and slot games have long been popular among gamblers, offering unique advantages. While sports betting relies on knowledge, analysis, and strategy, slot games focus more on luck and entertainment. But which one provides better-winning potential? Comparing PG Slot with traditional sports betting can help bettors decide which suits their gaming preferences and risk tolerance.

Sports betting and slot games have long been popular among gamblers, offering unique advantages. While sports betting relies on knowledge, analysis, and strategy, slot games focus more on luck and entertainment. But which one provides better-winning potential? Comparing PG Slot with traditional sports betting can help bettors decide which suits their gaming preferences and risk tolerance.

Over the past ten years, the terrain of online gambling has changed dramatically, combining several kinds of betting and games into all-encompassing systems suited for different interests. Among these new developments is the combining of sports betting with online lottery services, therefore giving gamblers an unusual and exciting experience. Online lottery services have become well-known in Indonesia by combining classic lottery games with the thrill of sports betting, therefore providing a fresh approach for fans to interact with their preferred sports while having a chance to win large.

Over the past ten years, the terrain of online gambling has changed dramatically, combining several kinds of betting and games into all-encompassing systems suited for different interests. Among these new developments is the combining of sports betting with online lottery services, therefore giving gamblers an unusual and exciting experience. Online lottery services have become well-known in Indonesia by combining classic lottery games with the thrill of sports betting, therefore providing a fresh approach for fans to interact with their preferred sports while having a chance to win large.